Starting a business is all about excitement, but no firm will keep going strong without smart money management. It is universally understood that managing finances properly can help shape a successful business from one that just barely makes it. Cash goes in and out of a business daily, but without control of where it is going your business can be destined to fail even if you’re the smartest Entrepreneur on the planet.

Consider your favorite local coffee shop or the tech start-up everyone’s obsessed with. Behind their prosperity is careful financial planning, wise spending decisions and the diligent tracking of every dollar. The entrepreneurs that are successful because they master their finances and continue to build on what’s already been built for generations.

This article reveals the actual strategies that successful business owners take to future-proof their finances and accelerate growth. So whether you’re looking to start your own business, or interested in learning how business owners juggle their finances, you’ll find real-life tactics that you can apply to work for yourself.

The Factor That Makes or Breaks a Business: How Well It Does the Money Thing

The majority of all new companies fail within the first five years, and one of the main reasons is a lack of financial management. Entrepreneurs who do not monitor their spending, dismiss cash flow issues, or make purchases without putting thought into it become unstuck sooner rather than later. Money issues bring stress, constrain options and eventually lead many entrepreneurs to hang up the towel.

Good fiscal management does the reverse. It provides entrepreneurs with clear insight into the health of their business who can now make informed decisions and look to grow. The moment you can tell how much money comes in the door, where it goes and what’s left over, is the same moment you can stop lurching from emergency to emergency and start planning for your future.

Good money management also allows more credibility with investors, banks and potential partners. When entrepreneurs can prove legitimate financials and being responsible with spending, you’ll get others investing in your vision. This unlocks the funds that can fuel faster growth.

Setting Up the Financial Foundation

Entrepreneurs can have all the money in the world, but until they have systems, which attract and hold onto it effectively, they will chase dollars forever. This foundation is the bedrock upon which everything else depends.

Separate Business and Personal Accounts

The first of those rules that is faithfully practiced by successful entrepreneurs, is to keep business money and personal money apart. Establish Boundaries: Dedicate Business Bank Accounts and Credit Cards. Opening business bank accounts and credit cards creates clear barriers. This distinction allows you to track business expenses, simplifies your tax preparation, and provides some recourse for protecting your personal assets if your business loses a court case.

This is why many businesses fail, because they want to mix everything. They use their personal bank accounts to pay the bills and take money out of a business account for personal purchases. This is confusing, makes keeping books a nightmare and raises red flags during tax audits.

Choose the Right Accounting System

Entrepreneurs must have established methods for recording every transaction. Some begin by keeping simple spreadsheets, which suffice for very small operations. Yet, most entrepreneurs tend to outgrow spreadsheets and soon invest in dedicated accounting software such as QuickBooks, Xero or FreshBooks.

These services can identify your expenses, create financial reports and take some of the pain out of tax season. They also sync with bank accounts, so transactions show up on their own without the need for manual data entry. This automation saves us hours every week and minimizes mistakes.

Establish a Chart of Accounts

A chart of accounts is essentially a filing system for money. It itemizes the myriad categories to which business money is devoted — rent, supplies, marketing, payroll and equipment among them. There are custom business categories that entrepreneurs can tailor to meet their specific needs.

Categories are also great for understanding where your money is going in a visual way. Entrepreneurs very quickly see that marketing costs have risen sharply, or supply expenses are down, and can figure out why.

Creating Budgets That Actually Work

Budgets are how you DO spending. For successful entrepreneurs, budgets are not constraints; they’re tools to help them reach goals.

Start with Revenue Projections

We start every budget by projecting income. Entrepreneurs review historical sales data, market trends, and anticipated marketing efforts to estimate future income. Getting too aggressive with estimates, though, can be a good way to ensure that you are overspending on money that may not even show up.

Newer businesses with no track record, founder-entrepreneurs research the industry averages and they talk to mentors running similar companies. These are the types of things that help establish realistic first-year expectations.

Allocate Funds by Priority

Once entrepreneurs know how much revenue to expect, they allocate it between various business needs. Necessary costs get paid first — things like rent, utilities, employee wages and inventory. These are costs the business can simply not exist without.

Then growth investments, including marketing, new equipment or more staff. Finally, the entrepreneurs have contingency money for unforeseen costs and opportunities. This prioritized process would make sure critical needs are funded first.

Review and Adjust Regularly

Budgets aren’t set in stone. You’ve heard successful entrepreneurs advice: “Look at your budget every month and review what you have spent compared to what you had planned.” They also look into why reality has strayed from budget projections, and make changes to future budgets as a result.

Perhaps marketing spending turned in some better-than-anticipated performance, indicating it probably makes sense for them to spend more. Or maybe costs for whatever was being supplied went up as a result of inflation, necessitating cuts in other areas. Budgets stay pertinent and practical because of regular review.

Mastering Cash Flow Management

Survival is cash flow — money that comes in as revenue, and goes out for expenses. Even companies with successful business models go belly-up when they lack the cash necessary to pay their bills. Entrepreneurs who figure out the cash flow game have a huge advantage.

Understanding the Cash Flow Cycle

Money doesn’t move instantly. Cash goes out for entrepreneurs long before they take cash in. They purchase inventory, pay employees and cover overhead costs while they wait for customers to pay them. This disconnect from outlays to income creates cash-flow problems.

An example to clarify: Consider a bakery that purchases flour, sugar and butter in order to bake cakes. They immediately outlay money for ingredients, but do not collect payment until customers purchase the finished cakes. For example, if the bakery makes a large amount of inventory or sells to its customers on longer payment terms, it could be in the position where it has profitable sales but runs out of cash.

Strategies for Positive Cash Flow

Here are a few strategies used by successful entrepreneurs to ensure cash keeps coming in – not slipping away:

Time To Collect: They incentivize getting paid faster, such as giving you small discounts if you pay immediately or requiring a deposit before they start work. Some switch to automatic payment systems that automatically charge customers’ cards.

Smarter Payment Terms: Business owners are extending payment windows with vendors and shortening the terms they grant customers. If they can pay suppliers in 60 days but collect from customers in only 30, the cash flow improvement will be very significant.

Inventory Management: Having too much inventory requires cash. Smart entrepreneurs do just-in-time ordering, carrying as little inventory as possible until they need to place a new order. This money can then be used elsewhere.

Cash Flow Forecasting: The best entrepreneurs predict the cash flow weeks or even months out. They follow likely sources of incoming payments and future expenses, flagging any apparent shortfalls before they materialize. The advance notice allows them to set up credit lines or postpone nonessential purchases.

Making Smart Investment Decisions

As they say, you have to spend money to make money: Growth is simply investing back in the business. Entrepreneurs are always choosing among the most effective investments.

Evaluating Return on Investment

Few successful entrepreneurs spend serious money without crunching the numbers on revenue potential. And they estimate how much additional revenue an investment will bring in compared to what it costs. If you’re spending $5,000 on a marketing campaign that’s generating $20,000 in new sales, you’re getting some good bang for your buck. Equipment that costs $50,000 and only earns you $40,000 in additional revenue over its useful life does not make sense.

This analysis helps the entrepreneur make sense of competing opportunities. When there are several alluring choices and resources are scarce, ROI calculations show which provide the most value.

Balancing Growth and Stability

It takes a lot of money to grow aggressively, which raises risk. Cash-conservative strategies are aimed at preserving lots of cash, spending on muscles (existing business) and limiting the space for expansion. For a given situation, successful entrepreneurs get this balance right.

Some plow almost all of the profits right back into a company in its early years and are willing to assume more risk for quicker growth. Some keep more cash on hand, growing very slowly but with less risk. The correct approach varies based on market conditions, competition and your risk appetite.

Timing Investments Strategically

For entrepreneurs the timing of their investments is as important as what they invest in — buying expensive equipment before a slow season is wasteful. Bringing on too much staff in an uncertain economy is not a good risk.

Smart entrepreneurs invest big when growth is most ripe. They grow most before the busy season, they hire when they have solid revenue to justify new salaries — and they cut back on discretionary spending during uncertain times.

Controlling Costs Without Sacrificing Quality

Reducing costs directly increases the bottom line. But if you slice too aggressively, you can wound the business. The smart entrepreneurs are cutting spending without undermining the customer experience or employee morale.

Identifying Cost Reduction Opportunities

Regular reviews of spending unearth waste and inefficiency. Entrepreneurs count every line item, questioning if anything is actually moving the needle for the business. Wasted subscriptions, too many supply orders and wasteful processes cost your organization money.

Many business owners review their costs quarterly, looking at all expenses with new eyes. They shop around amongst vendors, negotiate better prices and generally take out anything that doesn’t have a clear purpose.

Negotiating Better Terms

Everything is negotiable. Entrepreneurs and executives with the courage to simply ask for better deals frequently get them. Landlords may offer a discount just to keep good tenants. Suppliers usually give discounts when you order more or enter into long-term deals. The service providers often can give in on their bids regarding pricing.

The catch is that you come to the bargaining table like a grown up, with figures that support your requests. Entrepreneurs who can prove a competitor’s price or position themselves as long-term customers have more negotiating power.

Automating to Reduce Labor Costs

Technology enables business owners to do more with less. Though you have a machine sending the emails, it is to replace outreach. Chatbots handle common customer questions. It’s easy to move onto accounting software which frees you from manual record-keeping.

This automation requires some investment in the beginning, but it lowers the ongoing labor cost. They also reduce errors, and liberate workers for higher-value work that actually does grow the business.

Building Multiple Revenue Streams

Single source income puts you at risk. Smart business owners have multiple revenue streams to insulate themselves from changes in the market, and to cover for losses of clients.

Expanding Product or Service Lines

Companies that have more than one product or service also spread risk across a range of products. A graphic designer that also does website development and social media management has three streams of income, not one. If demand for one service wanes, it is propped up by the others.

Wise entrepreneurs bolt on, rather than disrupt existing offerings. This enables them to serve existing customers more fully while reaching new customer segments.

Creating Passive Income Sources

The residual income just keeps coming with barely any more work. Entrepreneurs generate passive income from digital products, licensing deals, affiliate arrangements, or subscription methods.

An ebook that makes its author money is, exclusively, a business consultant writing an ebook and selling it on the Web. A software company introduces a subscription model customers pay by the month, establishing predictable revenue streams.

Strategic Partnerships

Joining other businesses adds new streams of income. A wedding photographer might be affiliated to florists or venues, charging referral fees. A fitness trainer may team up with nutritionists, giving package deals that help both the parties.

These partnerships scale without heavy marketing investment, as new customers come through word of mouth recommendations.

Preparing for Financial Emergencies

All businesses encounter issues they never saw coming. Equipment fails, big customers defect, economic slumps depress demand or global events interfere with the best-laid supply chains. Entrepreneurs that anticipate emergencies are the ones who outlast the crises that bury unprepared competitors.

Building Emergency Reserves

Financial pros advise that businesses keep three to six months in emergency savings of operating expenses. This cushion offers breathing space during hard times, allowing entrepreneurs to make thoughtful, rather than desperate, decisions.

It requires discipline to build reserves because this money simply sits idle when things go well. But when emergencies hit, these reserves become priceless. They help avoid the need to take high-interest loans or to make panicked judgments like mass layoffs.

Insurance Coverage

Appropriate insurance mitigates against catastrophic losses. There are a variety of types of coverage that entrepreneurs will need depending on the kind of business they run — general liability, property insurance, professional liability and business interruption insurance.

These premiums sound expensive until catastrophe strikes. A fire that wipes out inventory, a lawsuit from an injured customer or a pandemic that requires closing can all cause uninsured businesses to go belly-up. Insurance translates these existential risks into minor hassles.

Diversifying Customer Base

Businesses that are heavily reliant on one or two big customers are overwhelmingly risky. Revenue can fall off a cliff if that key customer walks. The smart entrepreneurs are always out there trying to make sure the customer concentration isn’t more than ~10-15% of revenue.

It’s this kind of variety that builds resiliency and enhances bargaining power. If entrepreneurs don’t desperately need any one customer’s business, they can negotiate more favorable terms and walk away from unprofitable relationships.

Leveraging Financial Data to Inform Decisions

Numbers are narratives of business well-being. But entrepreneurs who have a grasp of the right financial metrics are simply better decision makers because they see issues before others and identify opportunities that others overlook.

Critical Metrics to Monitor

There are numerous financial metrics that ought to be monitored regularly:

Gross Profit Margin: The money left over after your cost of goods. This is what you have left over after you pay for all direct costs. If you make a product for $60 and it sells for $100, that’s a 40% gross margin. Greater margins free up room for other expenses and investments.

Net Profit Margin: This indicates the percentage of revenue that is profit after expenses. It demonstrates the general efficiency and sustainability of a business.

Customer Acquisition Cost: How much money does it take to acquire a new customer with marketing and sales? Put in relation to the customer lifetime value, one can determine whether growth makes any financial sense.

Cash Conversion Cycle: The amount of time money is tied up in inventory and receivables before it comes back as cash. Shorter cycles enhance cash flow and lower financing requirements.

Break-Even Point: Level of sales at which the business pays all its expenses without making a profit or incurring a loss. With that number in mind, the entrepreneurs now could set targets for minimum sales.

Here is a basic reference table showing how these metrics go hand in hand:

| Metric | What It Measures | Why It Matters |

|---|---|---|

| Gross Profit Margin | Revenue less direct costs | Demonstrates pricing power and efficiency |

| Net Profit Margin | Earnings on sales | Shows overall financial health |

| Customer Acquisition Cost | Cost of adding a new customer | Reveals marketing efficiency |

| Cash Conversion Cycle | How long money stays tied up | Affects cash flow |

| Break-Even Point | Sales needed to cover expenses | Sets minimum-performance threshold |

Creating Financial Dashboards

Smart entrepreneurs don’t use monthly financial statements to, finally, tell them where they are at financially. They develop dashboards to display important metrics in real time. These visual presentations can make trends as clear at a glance, allowing entrepreneur to react rapidly to evolving conditions.

Creating a dashboard is easy with the right modern accounting software. Entrepreneurs choose the metrics that are most important to them and then are given tools to display them as charts, graphs or plain numbers — data that updates automatically.

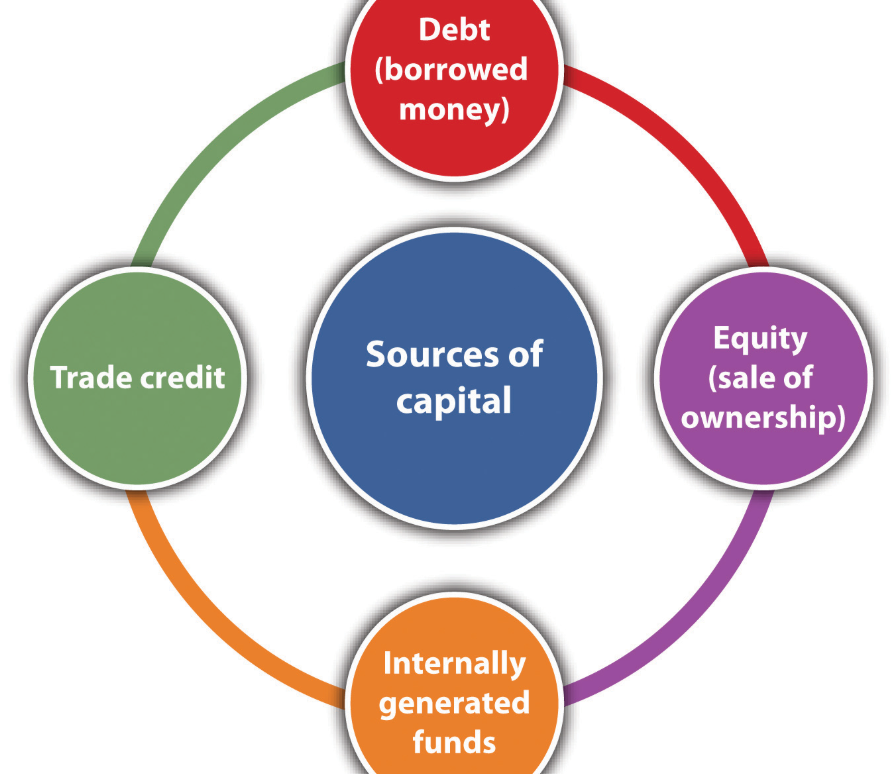

Managing Debt Strategically

Debt isn’t inherently bad. When used strategically, borrowing is a growth accelerator and opens up opportunities that would otherwise be out of reach if only internal funds were being used. The trick is taking on debt thoughtfully and being aware of its actual costs.

When to Borrow Money

Like smart entrepreneurs, they effectively borrow for investments that return more than the borrowing cost. If funds borrowed at 8% interest (annually) buy equipment that generates a return of 20% (a profit), then borrowing makes great sense.

Good reasons to borrow include:

- Purchasing equipment that improves efficiency

- Entering new markets with established potential

- Building inventory for anticipated growth

- Acquiring competing businesses

- Filling cash flow holes with short term credit

Bad ones would be, say, to cover up continuing operating losses or to fund lifestyle expenses that have nothing really to do with business growth.

Choosing the Right Financing

It serves as a purpose for different financing types. Bank loans, standard of course offer low rates but maintaining strong credit and collateral. Lines of credit work like a revolving account, and offer flexible access to cash flow funds in and out. With equipment financing the credit and owner of the business do not matter that much because the equipment itself is collateral. Invoice factoring is a service that turns the unpaid invoices from customers into cash now.

Entrepreneurs match financing products to their needs and credentials. They scrutinize terms with care, not only interest rates but also fees, repayment schedules and restrictions.

Maintaining Healthy Debt Levels

Debt brings dangerous pressure all of its own. Businesses that must allocate large chunks of their revenue to debt payments are at risk of any sort of revenue disruption. Business owners keep an eye on their debt to equity ratio, making sure that they will not be overleveraged compared to what is invested by the owner(s).

Lean entrepreneurs cap debt payments at 30% of monthly revenue. That leaves plenty of breathing room for recessions even while there’s ample incentive to borrow strategically in order to grow.

Planning Taxes Proactively

Taxes are big business expenses and they need year-round planning. Entrepreneurs who wait until tax season to consider taxes miss chances and will be subjected to surprises that are unwanted.

Understanding Tax Obligations

There are a number of different taxes that businesses pay, depending on their structure and where they operate — income taxes, payroll taxes, sales taxes and property taxes. All have different rules, deadlines and rates. Entrepreneurs need to know which taxes are applicable, and when payments should be made.

Penalties and interest rip through scarce cash when deadlines are missed. Adding calendar reminders for estimated tax payments, payroll tax deposits and annual filing deadlines will help avoid costly errors. For comprehensive guidance on small business tax requirements, visit the IRS Small Business and Self-Employed Tax Center.

Maximizing Deductions

Under tax laws, businesses are able to deduct legitimate expenses from taxable income. The more that founders are able to claim in deductions, the less tax they pay. Typical deductions include offices, equipment, supplies, marketing and promotion costs, professional fees (that is for lawyers and accountants), travel expenditures and employee benefits.

The trick is to have fastidious bookkeeping. Receipts, invoices and documents show expenses are legitimate business costs, not personal spending. Entrepreneurs are leveraging expense tracking apps or dedicated business credit cards to simplify their record-keeping.

Working with Tax Professionals

Laws pertaining to taxes change often and are highly complicated. The most successful entrepreneurs hire accountants or tax professionals who can not only stay on top of the regulations, but can also uncover savings opportunities.

These pros charge money, but often save clients not just their fees, but more, by being strategic about taxes. They also offer reassurance of filing accuracy and compliance to minimize the risk of an audit.

Scaling Financial Systems with Growth

Small business systems fail as companies grow. Entrepreneurs need to upgrade their financial systems for more complex businesses.

When to Hire Financial Staff

And as with many young entrepreneurs, finances were something they initially handled on their own. This is no longer feasible as companies scale. The first financial hire is typically a bookkeeper to deal with day-to-day transactions. Later come accountants, who produce financial reports and analyze the numbers. Eventually the bigger companies have CFOs who advise on financial strategy.

Entrepreneurs must know when to bring on these hires so that they don’t become bottlenecks. When financial duties are eating up so much time that it impacts strategic work, it’s time to delegate.

Upgrading Technology

Early on, you can get by with simple accounting software. And businesses on the rise require more robust tools that can manage multiple locations or complex inventory, accept international transactions or provide integrated payroll.

Cloud financial management systems enable teams to work together from anywhere. They also connect with other business software, which avoids duplicating data entry and reduces errors.

Implementing Financial Controls

Big organizations need to be properly secured with formal financial controls to ensure no fraud and mistakes. These steps include segregation of duties, where no one person controls entire transactions; approvals for large outlays; and regular audits.

While controls introduce some bureaucracy and drag on efficiency, they also safeguard assets and maintain accurate records. The cost of proper controls is negligible compared to losses from fraud or large mistakes.

Frequently Asked Questions

What’s the right amount of money for entrepreneurs to have in business savings?

The vast majority of financial advisers suggest keeping three to six months’ worth of operating expenses in emergency reserves. This is a cushion when times are slow, or things don’t go as planned. The precise number varies based on revenue stability — a business that has predictable income locally may need less of a cash cushion than one with seasonal or variable revenue.

What is the biggest financial mistake new entrepreneurs make?

The most frequent and harmful mistake is the personal/business money mix up. This leads to accounting nightmares, tax complications and the possibility that personal assets may be put at risk for business-related liabilities. Starting business accounts is one of the very first steps all entrepreneurs should make.

How often should entrepreneurs review their finances?

Basic financial metrics are reviewed daily or weekly by successful entrepreneurs, while thorough financial statement reviews are undertaken monthly. Quarterly deep dives into this data analyze trends, compare to budget, and strategic adjustments are made, while annual reviews assess overall progress and next year’s planning.

Is it better to bootstrap or seek outside investment?

Bootstrapping limits growth speed, but outside investment further accelerates this and nearly always involves outside investors or other lenders. Most entrepreneurs benefit from professional accounting help within their first year, as even if they handle daily bookkeeping themselves, having an accountant prepare tax returns and provide periodic financial reviews can prevent costly mistakes.

Can entrepreneurs without financial backgrounds succeed?

While complex financial terms might seem complex to those unfamiliar with them, financial management gets a lot easier once you get around to learning and improving your business’s financial skills. An entrepreneur’s financial acumen can determine that of his or her business.

Conclusion

Begin with the fundamentals — individual accounts, clear budgets and frequent money meetings. As they get comfortable, layer in more advanced practices such as cash flow forecasting, deep metric tracking and strategic tax planning. Every enhancement builds upon the business and opens new avenues for sustainable development.

Keep in mind that financial management isn’t about getting everything right. It’s about having a sense of purpose, staying informed and behaving thoughtfully on the basis of real data rather than gut feelings. Entrepreneurs who consider financial management to be a critical business duty instead of an annoyance position themselves for long-term success.

The best entrepreneurs use money as a resource to enable their vision. They respect it, treat it thoughtfully and spend it where they need to. None of those can compete with a business that is well managed, and not just financially but also operationally and strategically, unquestionably creating value over time.

There will be financial obstacles on your entrepreneurial adventure – random costs which suddenly appear, periods of meager pay-outs and prickly investment decisions. Together with that rigor in financial systems and management, these challenges can then be met as obstacles to be worked around rather than in existential terror. The time you spend learning financial management is a lifetime value to your business.