Running a business can’t only be about making sales and earning profits. It’s the liquidity to have money in your bank account when you need it. You may be surprised to learn that even successful companies can collapse simply because they run out of cash at the wrong time. It is a lot more common than you might think and it’s happening to everyone from small shops, online stores, to even growing companies.

Cash flow management might be compared to the challenge of keeping track of the water flowing through pipes in your house. Money comes in the door from customers (that’s the water flowing in), and money flows out to pay bills, workers and suppliers (there’s the water flowing out). When more water flows out than comes in, your pipes go dry. When you control this flow well, your business remains healthy and can expand without being constantly anxious about not having enough money to keep going.

Here you’ll find nine strategies for getting a handle on your cash flow. These are not fancy financial tricks that only accountants can get their heads around. They are simple tactics any business owner can start applying today to ensure they always have enough money on hand to pay their bills when they come due.

1. Accelerate Your Collection of Payments

There are many good causes of cash flow problems in business, and one of the major reasons is straightforward – customers don’t pay on time. Try doing a job today and not being paid for the next 30, 60, or even 90 days. During that waiting period, however, you still need to pay your rent, employees and suppliers. This leaves a gap that can be extremely damaging to your business.

The answer begins by making it irresistibly easy for someone to give you their money. Put yourself in their shoes. If paying you is hard — meaning they have to fill out convoluted forms, send checks in the mail, or their payment process involves multiple steps — they are likely to procrastinate on it. But if they can pay with a few clicks on their phone, they’re much more likely to do it there and then.

Here are ways in which you can get involved:

Set up multiple payment options. Take orders with credit cards, debit cards, digital wallets like PayPal or Venmo, bank transfers. The more options you provide, the fewer excuses a customer has for not paying.

Send invoices immediately. Don’t wait until the end of the week, or month. Send the invoice immediately when you have completed work or shipped product. Every day that you put it off is another day that you are waiting to see that money.

Clearly spell out your payment terms. It should be obvious when you’re required to pay based on your invoice. So, rather than using vague language like “Net 30,” instead write “Payment due by [a specific date].” This removes any confusion.

Chase late payments quickly. Do not hesitate to remind customers when they are overdue on payments. Remind a few days ahead of time with a friendly email, and when payment doesn’t arrive on schedule afterward ping them immediately.

Promote early payment through small discounts. You might offer a 2 percent discount if they pay in 10 days rather than 30. You get your money more quickly, and customers feel that they are getting a good deal.

| Method | Average Processing Time | Customer Convenience |

|---|---|---|

| Credit Card | 1-3 business days | Very High |

| Bank Transfer | 1-5 business days | Medium |

| Check | 5-10 business days | Low |

| Cash | Immediate | Medium |

| Digital Wallet | 1-2 business days | Very High |

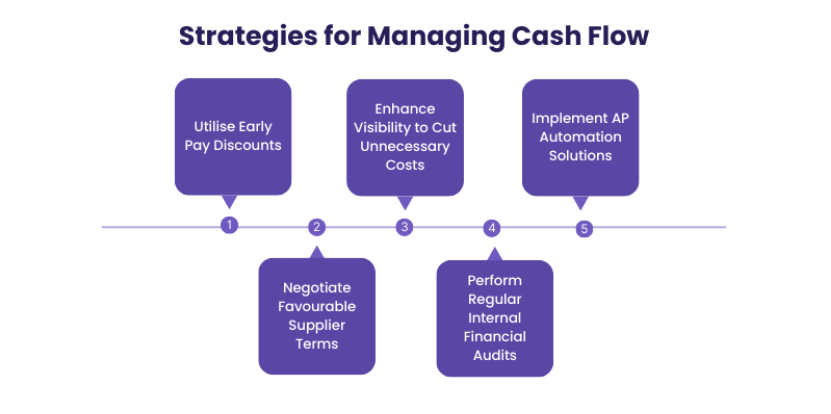

2. Renegotiate Terms With Suppliers

As you’re laboring to receive payment more quickly, you should be working just as hard to slow down how fast you pay others. This isn’t lying or sabotaging relationships. It could also mean arranging payment terms that are more favorable to your cash flow.

Most sellers have standard payment terms, but those can be negotiated. Many will negotiate, particularly if you are a good customer who pays on time. The key is to ask. The number of times that businesses never even attempt to negotiate better terms will surprise you.

Ask for extended payment periods. For example, if your current terms are “net 30,” meaning that you must pay within 30 days, see if you can extend it to 45 or even 60 days. This cushion adds a little extra time to the equation.

Request early payment discounts. Some vendors will offer a discount if you pay early. But, here’s the thing: you should only take this deal if you really have extra cash lurking around. It is not worth it if you are going to be struggling later, so don’t overdo your early payments.

Negotiate volume discounts. You may be eligible for better prices if you purchase in bulk. This is an immediate boost to your cash flow, since you’re cutting down on the money that’s flowing out of your business.

Build strong relationships with suppliers. When the going gets rough, suppliers will be more inclined to cooperate with you if they know you are a reliable and communicative business partner. Keep them informed about your business, pay on time whenever possible and think of them less as vendors than partners.

Consider consignment arrangements. For certain products, you might be able to work out a consignment where you don’t pay for items until they sell. This is a huge boost to cash flow, especially for retailers.

3. Watch Your Stock Closely

Inventory is cash on shelves. Each product you buy for resale or raw material you buy to make something is an opportunity for cash that could be used elsewhere. Too much inventory chokes your cash flow, while too little can cause you to lose sales opportunities.

Consider your inventory as you would food in your refrigerator. You need enough for your family’s meals, but if you buy too much, it just ends up spoiling before you can eat it. That’s wasted money. The same is true of business inventories.

Keep track of what flies off the shelves and what lingers. Use basic inventory tracking tools or, if need be, a spreadsheet to keep an eye on which products move and which are collecting dust for months at a time. Concentrate on buying more of what sells and less of what doesn’t.

Where possible adopt “just-in-time” philosophy. This involves ordering stock as you need it and not keeping huge amounts in storage. Part of it is having strong relationships with suppliers who can deliver efficiently, but it frees up a lot of cash.

Launch sales to get rid of slow-moving products. If there are some products that just aren’t selling, don’t let them sit gathering dust. Try to sell them off. At least you’ll get some cash back rather than have it be all tied up in unsold merchandise.

Specify minimum and maximum stock levels. Choose the smallest number of each product you’ll want to avoid running out, and the largest quantity you should ever end up with. This way you won’t face any stock-outs nor end up with unused goods.

Review inventory regularly. At least once a month take stock of what you have. This allows you to catch problems early and adjust your orders accordingly.

4. Create Accurate Cash Flow Forecasts

Now drive your car in the dark without headlights. You’d hit the wall pretty soon anyway, because you can’t see where you’re going. It’s kind of like running a business without cash flow forecasts. You want to be able to see what’s coming so you can prepare.

A cash flow forecast is essentially a prediction of when money will be coming in and out the business. It doesn’t have to be perfect, but you should have a rough idea of whether you’re going to have enough cash in the next week, month or quarter.

Begin with an easy weekly prediction. Look forward for the next four weeks. Keep a list of every payment you expect to receive and every bill you need to pay. Include the amounts and dates. That gives you a rough sketch of your cash position.

Include all sources of income. Don’t just count on sales. If you anticipate receiving a tax refund, loan or money from investors, note the amount and when it’s expected to be issued.

Don’t forget seasonal patterns. It’s the same for most kinds of businesses. If you own a landscaping business, for instance, summer is go time and winter tends to be slower. If you’re selling products for back-to-school days, August and September are critical months. This seasonality pattern should definitely be incorporated into your forecast.

Be realistic, not optimistic. For income prediction, it’s always best to go with moderate estimates. It’s better, anyway, to be pleasantly surprised with extra cash than to plan for money that never comes. When estimating expenses, be thorough. It’s also not hard to overlook intermittent costs, such as annual insurance payments or quarterly tax estimates.

Update your forecast regularly. Your forecast isn’t one that you put together, and then never touch again. Update it weekly or at least monthly as you get actual numbers. This is what makes it accurate and practical.

| Week | Expected Income | Expected Expenses | Net Cash Flow | Running Balance |

|---|---|---|---|---|

| Week 1 | $5,000 | $3,500 | $1,500 | +$1,500 |

| Week 2 | $4,200 | $6,000 | -$1,800 | -$300 |

5. Build an Emergency Cash Reserve

Life is unpredictable. Equipment breaks down. Key customers suddenly stop ordering. Economic downturns happen. Health crises occur. When that’s your business, you need cash on hand today to respond to them.

Think of that as your emergency cash reserve — a financial cushion to keep your small business from imploding when you hit an unexpected problem. Without this cushion, one unexpected cost could potentially force you out of business or push you into costly loans.

You should aim to stash away enough to cover your expenses for three to six months. Estimate how much money you require each month to keep your business operational (rent, payroll, utilities, minimum inventory, etc). Multiply that by three to six. That is your goal for your emergency reserve.

Start small if necessary. Otherwise an ultra-large target will feel like too much of a mountain to climb. If the idea of six months’ worth of expenses seems out of reach, make your first goal smaller. Even having $1,000 or $2,000 in savings is better than none. Then, as soon as you achieve that goal, set one that is larger.

Deposit the money in an account of its own. Do not commingle your emergency fund and your operating account. A new savings account just for emergencies. This separation makes it less prone to being tapped for non-emergencies.

Add to it regularly. Treat the work of building your emergency reserve like any other business expense. That adds up, even if you’re just putting away $50 or $100 a week. Make it automatic: Establish a recurring transfer from your operating account to your savings account.

Establish what is and isn’t an emergency. Be honest with yourself about when you’ll want to use this money. Real emergencies are when vital equipment has broken down, a prime customer won’t pay up or unexpected downturns in the economy. A sale on new gear is not an emergency. Neither is an impulse buy, even if a good impulse.

6. Slash Wasteful Spending Without Impacting Your Organization

Every dollar you can save by not buying something unnecessary is a dollar that stays in your business. However, cutting expenses is tricky. Cut too little and you may limit your ability to operate or expand. Cut too much and you’re wasting money that could boost your cash flow.

The trick is to separate the expenses that make your business grow from those that only suck money without much in return.

Look at all your subscription-based services. Plenty of businesses shell out for software, services or memberships they hardly use. Review your bank and credit card statements for the last few months. Highlight every recurring charge. Are we even using this? Does it offer enough bang for the buck? If anything doesn’t, cancel it.

Haggle lower prices for essential services. For the expenses for which you want to retain the information, call the providers and request better rates. The cost of internet, phone service, insurance and processing credit cards are often negotiable. The worst they can do is say no, but they could say yes and save you a lot of money.

Reduce energy costs. Small changes such as switching to LED bulbs and mild thermostat adjustments, as well as unplugging equipment not in use will lower utility bills. Individually, these savings may seem negligible, but month after month they can add up.

Evaluate your space needs. If you’re paying for office or storage space you’re not fully utilizing, look into downsizing. Commercial rent can be one of a business’s largest expenses. Even downsizing to a slightly smaller place can unlock significant cash every month.

Be strategic about marketing spending. Monitor the marketing strategies that are working to get customers and sales. Stop spending on things that absolutely don’t work, and invest more in those that do.

Search for less expensive alternatives that don’t sacrifice quality. Sometimes you can identify comparable products or services for less that are just as good. However, be careful. Opting for the absolute cheapest can come back to bite you if quality suffers and customers desert.

7. Consider Alternative Financing Options

Now and then, even with the best of intentions, you require more cash to get through a temporary shortfall or capitalize on growth. Bank loans aren’t the only deal in town, and they are often not the deal you need for cash flow.

Invoice factoring or financing. If you have unpaid invoices from customers that haven’t yet paid, the factoring company will give you cash upfront (typically 70-90% of the value of your invoice) and collect payment later from your customer. You pay a premium for this service, but it can help solve short-term cash flow problems.

Business line of credit. Unlike a regular loan in which you borrow the entire sum up front, a line of credit allows you to borrow incrementally until you reach a predefined maximum amount. You pay interest only on what you use. This flexibility also makes it great for dealing with seasonal lulls.

Equipment financing. If you don’t want to deplete your cash reserves, but need some expensive equipment, financing can help reduce the strain by letting you pay for that equipment in small payments rather than all at once. The equipment in question generally acts as collateral.

Merchant cash advances. If you accept credit card payments, some companies will provide cash up front in exchange for a percentage of your future sales from credit cards. It can be costly, but it’s quick and doesn’t have to be documented in the same detail as traditional loans do.

Personal and business credit cards thoughtfully. If credit cards aren’t the perfect vehicle for long-term financing, as a result of their high interest rates, they are useful in managing short-term cash flow concerns. If you will be paid in 30-45 days and need to pay a bill today, a credit card can help bridge that gap. Make sure you pay the balance off quickly.

Seek out a partner or an investor. If your business has scale potential, bringing in a cash investor through a partnership could be workable. This isn’t repaid like a loan, which can free up cash flow considerably.

8. Implement a Cash-First Budgeting System

When it comes to budgets, the vast majority of people think in terms of profits and losses. For managing cash flow, however, you need to think differently. You require a cash-first budget that deals in nuance, and precisely when, where and how much money comes into or out of your business — not just whether you turn a profit.

Even a profitable business can have lousy cash flow if the timing of income and expenses isn’t in sync. For instance, you could have a big sale in January and not get paid until March. And, of course, you need to pay your employees and rent in February while awaiting that payment. The funds you generate from that sale is no help at all to your February cash flow.

Prepare a map of your fixed outgoings by date. Write out all your regular monthly expenses (rent, loan payments, insurance premiums, subscriptions, etc.) and when each one needs to be paid. This makes a calendar of your cash obligations.

Plan for variable expenses. Certain costs ebb and flow according to your sales or the season. Base these on your history and forecast. Add them to your cash calendar with a plausible timeline.

Try to match your spending with the timing of income. Consider timing large optional expenditures for periods when you project strong cash inflows. If you’re certain you’ll have some large client payments in the last week of the month, that’s a great time to pay suppliers or invest in equipment.

Create spending rules. Set clear boundaries on when and how money can be spent. For instance, you could determine that no purchase of more than $500 can be made without determining the current cash position and coming obligations.

Check the cash before making any major decision. Before you hire someone, purchase equipment or make any decision that constricts the flow of cash out of your business, check your current cash position and forecast. Ensure that your finances support the initial cost, along with continued obligations.

9. Automate Financial Monitoring and Reporting

What you don’t measure, you can’t manage. If you don’t really know when and where your money is going out, it’s like flying blind. The manual tracking process is labor-intensive, error-prone and usually incomplete. Automation solves these problems.

Today’s accounting and bookkeeping software is not expensive or difficult to learn. You’d be surprised at how even a few simple tools can make a big difference in your ability to track and manage cash flow. The time saved and insights gained are far more valuable than the price.

Choose the right accounting software. Choices such as QuickBooks, FreshBooks, Xero or Wave have features tailored to small business operations. Many have free trials so you can test them first. Choose one that suits your requirements and technical comfort.

Connect your bank accounts. Most accounting software integrates directly with your business bank accounts and credit cards. Transactions import automatically, freeing you from the need to log every deposit and payment. This also means your books are always current.

Set up automatic invoicing. Set up your system to automatically invoice when you have finished working or shipped product. You can even schedule late payment reminder emails on an automatic basis. This way, nothing is lost in between the cracks.

Generate cash flow reports regularly. With good accounting software, cash flow reports can be generated in a few clicks. Check these out weekly or monthly. Find patterns, spot problems early and use data to make better decisions. Learn more about cash flow analysis best practices to improve your financial reporting.

Use dashboards for quick insights. Many tools offer dashboard views that display your most important numbers at a glance: current cash balance, outstanding invoices, upcoming bills and the like. Check this dashboard daily, just as you would look at your speedometer while driving.

Automate recurring transactions. If you have bills that aren’t different month-to-month (i.e. your rent or some subscriptions), automate them — automatic payments and online banking will save you time, money, and peace of mind. This helps you maintain good standing with vendors and avoid missed payments.

Track everything in real-time. With automation, you get a strict insight into what your cash flow position is at any time. No more guesswork or waiting until the end of the month to see where you stand. Real-time data helps you to just be on time.

Frequently Asked Questions

What is the difference between profit and cash flow?

Profit is what remains after you make money and spend money over a certain span of time, such as a month or year. Cash flow is a matter of timing — when money actually comes in and goes out the door at your business. You can be profitable on paper and still run out of cash if customers pay you slowly and you must pay your bills quickly.

How much cash reserve should small business keep?

Financial advisers usually recommend having enough of a cash cushion to pay for an average three to six months of operating expenses. But start with what you can do. Having even a month of expenses set aside is much better than nothing, and offers a cushion for emergencies.

Is it a good idea to offer discounts in exchange for faster payment?

Providing small early payment discounts (from 2 percent for payment within 10 days) can be smart if faster paying helps your cash flow enough to justify the discount. Figure out whether it’s more valuable for you to have the cash sooner, than the discount you’re giving up.

How frequently should I review my cash flow?

Review these figures on a daily, or at least semi-weekly, basis. Check against your cash flow forecast and reports each week in more detail. In your monthly reviews, meticulously think through trends and updates on how you’re managing.

Can I generate more cash flow without adding debt?

Absolutely. None of the strategies in this article rely on borrowing. Faster collections, longer payment terms with suppliers, better inventory management, the pruning of unnecessary expenses and improved forecasting all enhance a business’s cash position and don’t require debt.

What is small businesses’ No. 1 cash flow mistake?

The worst mistake is not tracking cash flow at all. So many business owners are concerned only with sales and profits and not when money flows in. The result is a surprise when the business cannot pay the bills, even if it appears profitable in theory.

Is invoice factoring expensive?

Invoice factoring fees usually range between 1-5% of the invoice amount, which varies based on how long your customer takes to pay and what industry you’re in. This may be costly, but it is worth considering if you need cash in a bind and don’t have any better options. Compare the expense to other types of financing.

I have a new business, so how can I predict cash flow?

If you are a new business with no historical data, use industry averages or comparisons to estimate low. Begin with a basic forecast and revise it frequently as follow-on information is collected. You will get better over time at predicting.

Master Your Business’s Financial Health

You don’t need an accounting degree or a fancy financial strategy to manage your cash flow. It demands attention, discipline and application of simple principles over time. The nine tactics discussed in this guide are their very definition.

Begin with the approaches that feel like they will be most straightforward to put in place for your unique circumstances. Maybe that leads to offering several payment options so customers can pay you more quickly. It could be an honest dialogue with your top suppliers about extending payment terms. Or it might just require a weekend, reviewing all your subscriptions and weeding out the things you don’t need.

The businesses that survive are not always the ones with the highest sales or biggest profits. They’re the ones with enough cash on hand when it counts the most. That’s job security — knowing that they can pay their employees when they need to, take advantage when opportunity strikes and not be overly fazed by the unpredictable shocks of life.

It’s the equivalent of keeping track of your health. You can’t do it once and be done with it. It’s something you have to take care of and manage. But the work is worth it in terms of reduced stress, better decisions and a business that’s been built to last. These strategies don’t set you free: They give you the tools. Now it’s on you to put them into practice and see your business financial health start improving week over week, month over month.